Beyond establishing essential credit, it might take several yrs to construct and preserve a powerful credit background.

Make a proposal on your own aspiration residence. After you’ve identified the ideal spot, submit your best provide along with a duplicate of one's preapproval letter. In case your offer you is acknowledged, you’ll also pay back the essential earnest income deposit to show your determination to your transaction.

Get credit for non-classic payments. Experian Increase®ø is really a free of charge function that permits you to include specified charges in your Experian credit file that are not historically A part of credit experiences. Qualified bills incorporate rent, utilities, cellphone, coverage as well as some streaming subscriptions.

Inside Every single of these kind of mortgage loans, most lenders offer you possibly preset-rate or adjustable-fee financial loans. It's possible you'll prefer the stability of your regular month-to-month payment with a fixed-charge mortgage or prioritize the very low introductory payments having an adjustable mortgage, particularly when you expect to enhance your cash flow after some time.

Other merchandise and business names described herein are the home of their respective house owners. Licenses and Disclosures.

This Examination is important for properly being familiar with a model's visibility, reliability, and authenticity. We then align the Resource's rating with our 0-10 ranking procedure for a precise evaluation. If we can't get yourself a score from this Instrument, Fund.com's Whole Score will depend only to the copyright score.

One particular type is the home equity line of credit (HELOC), which will allow house owners to borrow towards the worth of their home for renovations or other uses.

Mortgage lenders are seeking creditworthy applicants with sufficient revenue, steady repayment histories and manageable levels of debt.

On a monthly basis you pay principal and curiosity. The principal is definitely the portion that’s paid out down on a monthly basis. The fascination is the rate billed every month by your lender. In the beginning you fork out more curiosity than principal. As time goes on, you pay back much more principal than interest right until the balance is paid off.

The lender may even confirm your deposit and resources for closing. The underwriting agent will ensure the supply of substantial deposits as part of your account and ensure that you've got dollars reserves.

Make all payments on time and decrease your credit card balances: Your payment history on your report goes again two several years or extended, so start off now if you can.

Along with spending closing expenditures, you can review and sign plenty of documentation on the closing, which includes particulars on how funds are disbursed. The closing or settlement agent may also enter the transaction into the general public file.

When you've got a powerful credit rating and can find the money for to produce a large down payment, a standard mortgage is the greatest pick. “Conventional financial loans are flexible and suited to a wide range of homebuyers, Specially those with very good-to-fantastic credit scores, stable profits, and some price savings to get a down payment,” claims Matt Dunbar, senior vice-president of Southeast Region for Churchill Mortgage.

” Be check here mindful that mortgage preapproval differs from prequalification. A preapproval requires way more documentation and a hard credit Examine. Mortgage prequalification is less formal and is basically a means for just a lender to tell you which you’d be a fantastic applicant. Even now, preapproval doesn’t assurance you’ll have the mortgage. That has to wait until finally you’ve manufactured a suggestion with a home and correctly passed through mortgage underwriting. Stage 7: Get started dwelling-hunting

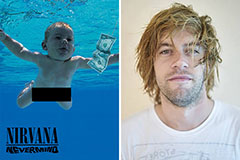

Spencer Elden Then & Now!

Spencer Elden Then & Now! Amanda Bynes Then & Now!

Amanda Bynes Then & Now! Joshua Jackson Then & Now!

Joshua Jackson Then & Now! Burke Ramsey Then & Now!

Burke Ramsey Then & Now! Lucy Lawless Then & Now!

Lucy Lawless Then & Now!